idaho state income tax capital gains

Idaho Statutes are updated to the web July 1 following the legislative session. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed.

Zero percent 15 percent or 20 percent.

. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. 52 rows Find the Capital Gains Tax Rate for each State in 2020 and 2021. Additional State Capital Gains Tax Information for Idaho.

Link to all our income tax guides and related information. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. Statement of Purpose Fiscal Impact.

However certain types of capital. The 2022 state personal income tax brackets are. Write to us at.

IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules. If you are in the 396 bracket your long-term capital gains tax rate is 20. Before the official 2022 Idaho income tax rates are released provisional 2022 tax rates are based on Idahos 2021 income tax brackets.

Capital Gains Tax in Idaho. In Idaho the uppermost. Email the Rules Coordinator.

The deduction is 60 of the capital. Section 63-3039 Idaho Code Rules and. Period requirement for capital gains purposes.

Income Tax Idaho Code Title 63 Chapter 30 Income Tax. The corporate income tax rate. The increase in value of 500 is the amount of capital gains income realized by the taxpayer.

General Information Use Form CG to compute an individuals Idaho capital gains deduction. STATEMENT OF PURPOSE RS 11318 This bill will extend the Idaho capital gains deduction to corporations engaged in agriculture timber or mining. Idaho axes capital gains as income.

Learn more about options for deferring capital gains taxes. If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15. Idaho Capital Gains Tax.

The long-term capital gains tax rate is going to be dependant on your taxable income and filing status but will fit within one of three rates. Capital gains are taxed as regular income in Idaho and subject to the personal income tax rates outlined above. Meeting dates and locations are listed on the Income.

Taxes capital gains as income and the rate reaches 575. If the sale occurs within a year of the purchase these are considered short-term. Taxes capital gains as income and the rate reaches 66.

The land in Utah cost 450000. Rules Coordinator Idaho State Tax Commission PO Box 36 Boise ID 83722-0410. Deduction of capital gains.

See Absent from Idaho for 445 days in a 15-month period Example A. Generally if youre domiciled in Idaho you must file an Idaho income tax return. The land in Idaho originally cost 550000.

2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 Calculate your tax rate based upon your taxable income the first two. Idahogov Newsroom HelpSearch Idaho State Tax Commission. 1 If an individual taxpayer reports capital gain net income in.

Taxidahogovindrate For years. The percentage is between 16 and 78 depending on the actual capital gain. Idaho state capital gains tax rate 2021 Sunday February 27 2022 Edit.

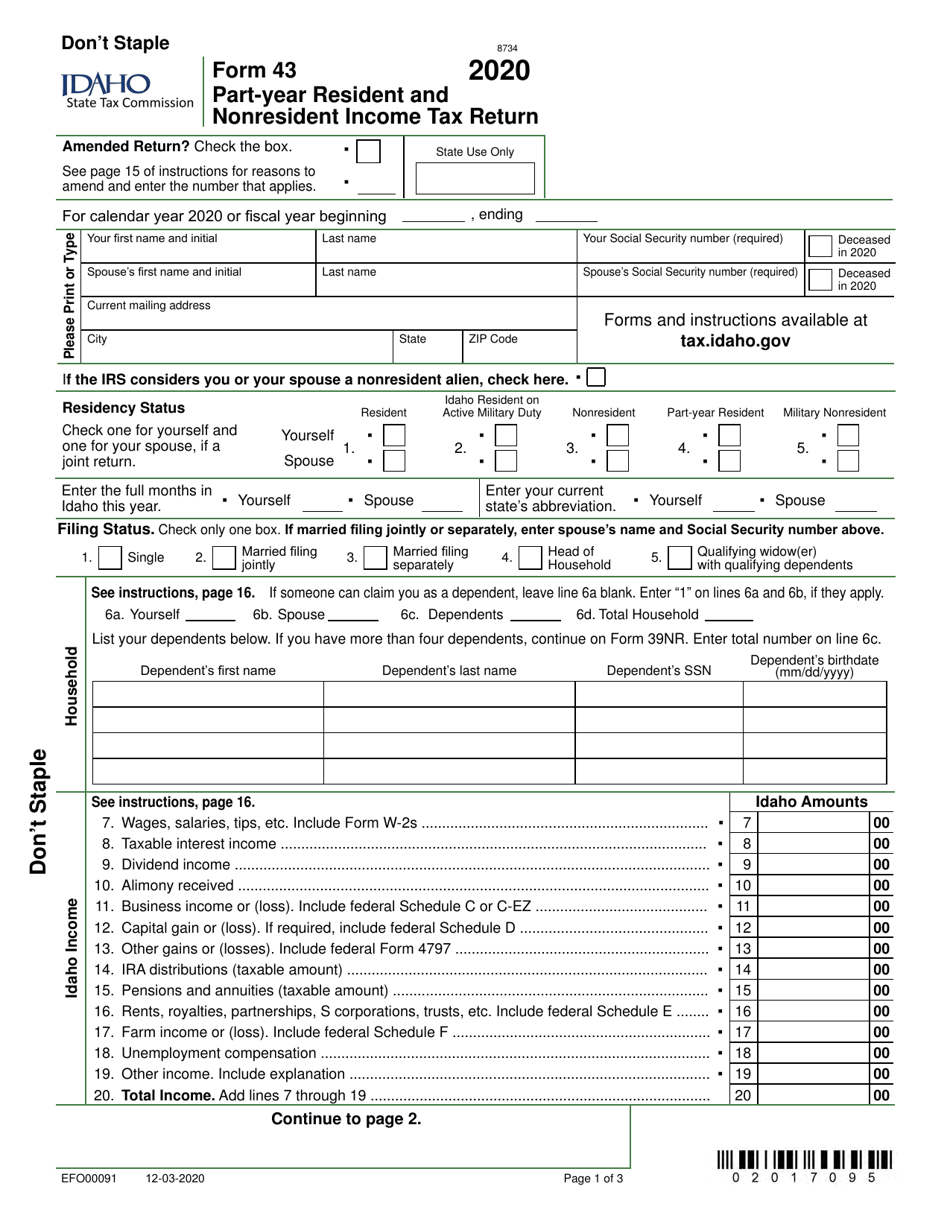

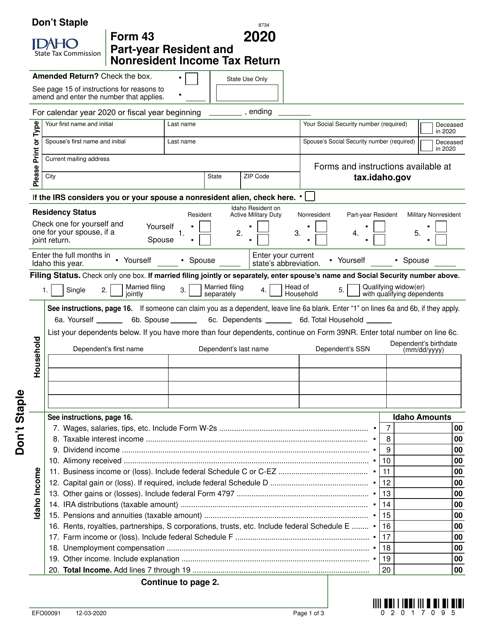

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Historical Idaho Tax Policy Information Ballotpedia

Idaho Tax Forms And Instructions For 2021 Form 40

Historical Idaho Budget And Finance Information Ballotpedia

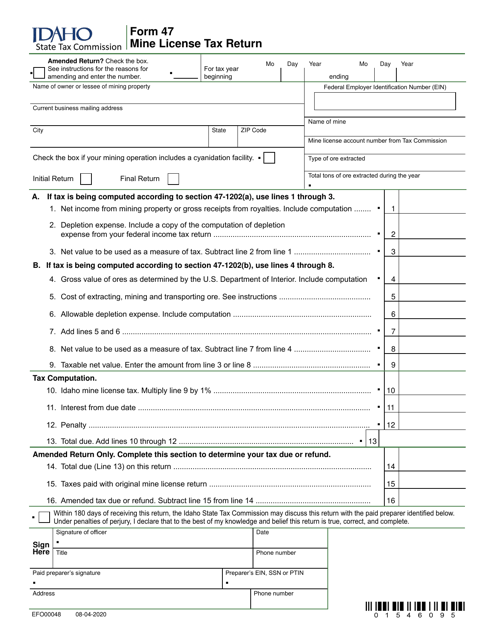

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Idaho Income Tax Calculator Smartasset

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Historical Idaho Budget And Finance Information Ballotpedia

Idaho Income Tax Calculator Smartasset

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Guide To Combined Reporting Idaho State Tax Commission

Where S My Refund Idaho H R Block

Idaho State Tax Software Preparation And E File On Freetaxusa

Idaho Income Tax Brackets 2020

Prepare And E File 2021 Idaho State Individual Income Tax Return

Guide To Combined Reporting Idaho State Tax Commission

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com